Despite the recent modest profit-taking in the S&P 500, the market – just shy of its all time high 2,400 level – remains in nosebleed valuation territory.

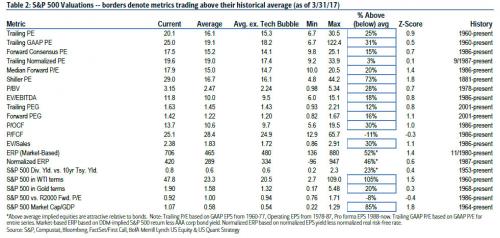

As Bank of America calculates, in March the S&P 500 forward P/E was little-changed amid a flat month for stocks, and at 17.5x continues to trade at its highest levels since 2002 (on a trailing basis P/E is at 19.6 and 29.0 based on the Shiller PE). This is almost one turn higher since we last performed a similar valuation exercise back in December.

Hardly a bargain, stocks remain stretched vs. history on the majority of metrics Bank of America tracks (Table 2) and as Savita Subramanian points out, the only way stocks still look cheap is relative to bonds. While BofA is quick to warn that today’s elevated valuations suggest longer-term caution on stocks, it reminds clients that “valuations typically…

View original post 207 more words