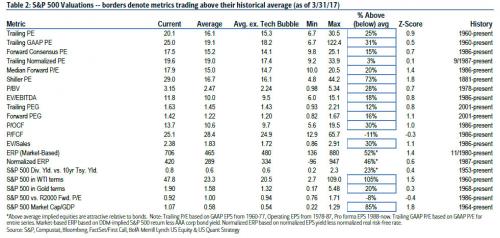

Despite the recent modest profit-taking in the S&P 500, the market – just shy of its all time high 2,400 level – remains in nosebleed valuation territory.

As Bank of America calculates, in March the S&P 500 forward P/E was little-changed amid a flat month for stocks, and at 17.5x continues to trade at its highest levels since 2002 (on a trailing basis P/E is at 19.6 and 29.0 based on the Shiller PE). This is almost one turn higher since we last performed a similar valuation exercise back in December.

Hardly a bargain, stocks remain stretched vs. history on the majority of metrics Bank of America tracks (Table 2) and as Savita Subramanian points out, the only way stocks still look cheap is relative to bonds. While BofA is quick to warn that today’s elevated valuations suggest longer-term caution on stocks, it reminds clients that “valuations typically…

View original post 207 more words

Clif High tells FinanceAndLiberty his calculations are predicting a “gold rush” in the coming months. As for the silver market, High says a slippage of control will occur between now and May.

Clif High tells FinanceAndLiberty his calculations are predicting a “gold rush” in the coming months. As for the silver market, High says a slippage of control will occur between now and May.

[ZurichTimes] Clif does not hold back in this interview with Greg Hunter and forecasts we are in “an extinction level event” scenario based on his predictive linguistics data mining. Bond Market Crash around September, 2017 and Economic Collapse to coincide with Currency Market Crash. And yes Google has gone Evil.

[ZurichTimes] Clif does not hold back in this interview with Greg Hunter and forecasts we are in “an extinction level event” scenario based on his predictive linguistics data mining. Bond Market Crash around September, 2017 and Economic Collapse to coincide with Currency Market Crash. And yes Google has gone Evil.

Something odd happened late in the day in Wednesday’s trading session, which prompted a number of people to mail in comments or ask a question or two. Since we have discussed this issue previously, we decided this was a good opportunity to briefly elaborate on the topic again in these pages.

Something odd happened late in the day in Wednesday’s trading session, which prompted a number of people to mail in comments or ask a question or two. Since we have discussed this issue previously, we decided this was a good opportunity to briefly elaborate on the topic again in these pages.