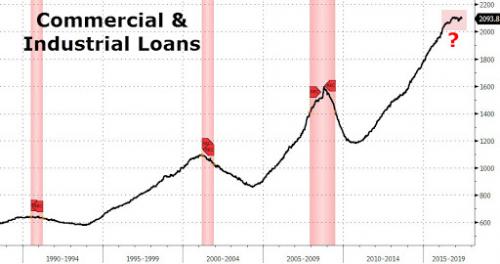

While many “conventional” indicators of US economic vibrancy and strength have lost their informational and predictive value over the past decade (GDP fluctuates erratically especially in Q1, employment is the lowest this century yet real wage growth is non-existent, inflation remains under the Fed’s target despite its $4.5 trillion balance sheet and so on), one indicator has remained a stubbornly fail-safe marker of economic contraction: since the 1960, every time Commercial & Industrial loan balances have declined (or simply stopped growing), whether due to tighter loan supply or declining demand, a recession was already either in progress or would start soon.

This can be seen on both the linked chart, and the one zoomed in below, which shows the uncanny correlation between loan growth and economic recession.

And while we have repeatedly documented the sharp decline in US Commercial and Industrial loan growth over the past few months (most…

View original post 132 more words