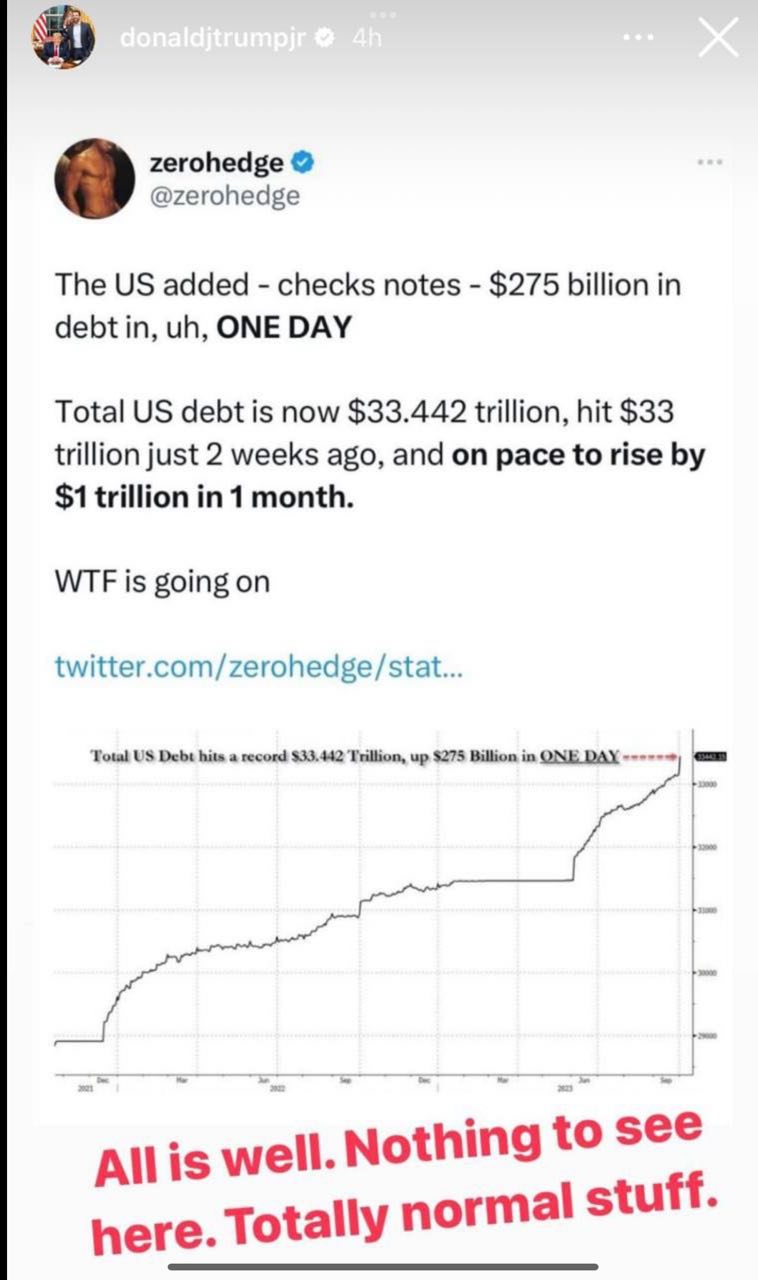

$275 billion of treasury notes issued in one day? $1 trillion of debt added in a month? What’s going on? Very simple! Cabal printing presses are no longer printing. They have to get the money from somewhere! lol desperate measures! 😂😂😂

Tag: INTELPIC

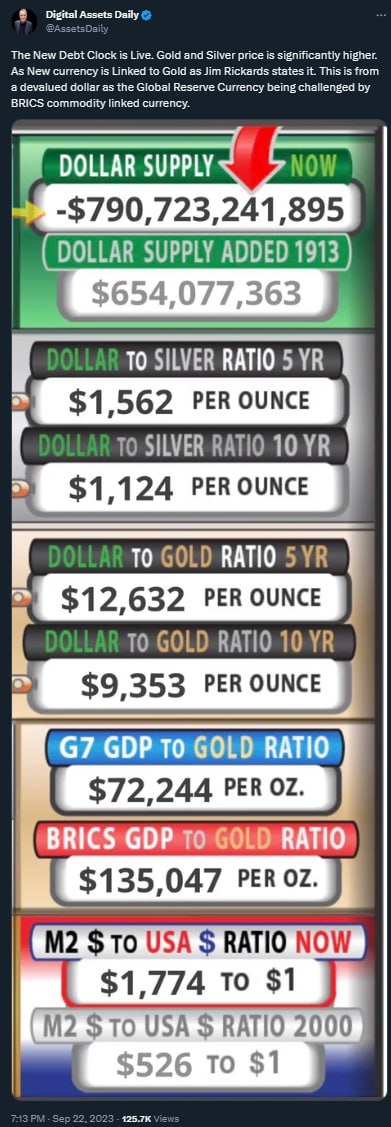

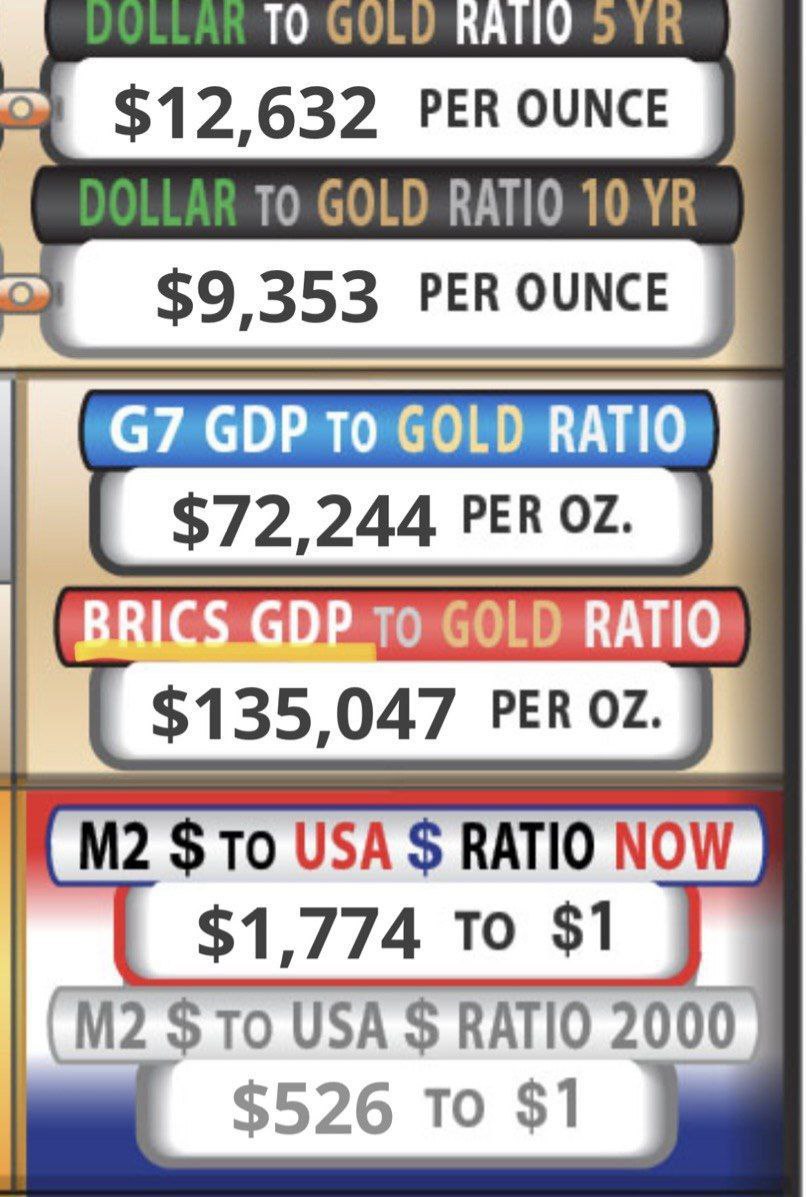

This is the most important Colume on the Tres Clock “US TRESURY DOLLARS 2025”. When you click on the red, white & blue box you will get a pop-up for NON-Interest-Bearing Money that indicates REAL Wealth Based Debt Free Currency Back by Gold. This in only what is showing on the books currently. It’s much, much larger when GDP and BRICS is calculated in. They are telling us what is coming…just like Lincoln & Kennedy did outside of the London bankers and NON FED BANKS (NO CENTRAL BANKERS) can touch it.

George Clooney is ‘selling his famous $100M Lake Como Villa’ that he has owned for more than two decades

Assets Seized👊💥

https://www.dailymail.co.uk/tvshowbiz/article-12553977/George-Clooney-selling-Lake-Como-Villa.html

Aerospace giant Boeing NYSE:BA is set to open a 43-acre facility, its largest outside the U.S., in India.

Boeing has set a target of ~$1.25 billion per year in sourcing from India and is investing nearly $200 million in the complex near Kempegowda International Airport in India. Earlier this year, Boeing announced a $100 million infrastructure investment to train pilots in the country.

Russia becomes UAE’s main gold source

The United Arab Emirates relied heavily on Russia as its primary source of gold in 2022, importing 96.4 tons. This quantity accounted for approximately one-third of Russia’s annual gold production and represented a remarkable increase of over 15 times compared to 2021.

Traditionally, the UAE has been a crucial hub for trading precious metals, particularly those originating from Africa and India. However, it was only last year that the country emerged as a significant player in the Russian gold trade.

With Western sanctions limiting Russia’s conventional export channels, mining companies in the country were compelled to seek alternative avenues for selling their gold. Consequently, Dubai, Istanbul, and Hong Kong emerged as key centers for Russian gold trade, as reported by Bloomberg.

In addition to Russia, Mali and Ghana also served as major gold suppliers to the UAE, providing 95.7 tons and 81 tons, respectively.

Meanwhile, Switzerland emerged as the predominant destination for Arab gold exports, receiving a substantial amount of 145 tons.

Follow us on Telegram and Twitter

🇨🇳 No more Chinese metals for the West

China’s exports of germanium and gallium fell sharply in August, according to customs data showed on Wednesday, after Beijing imposed new controls on exports of the two metals used for chip production.

China exported no wrought germanium products last month, down from 8.63 metric tons in July, when shipments more than doubled year-on-year, as overseas buyers rushed to lock in shipments ahead of the restrictions.

There were also no exports of wrought gallium products in August. In July, exports were 5.15 tons and 7.67 tons in the same month in 2022, the data showed.

In July, China announced export restrictions on eight gallium and six germanium products, which came into effect on August 1.

This is the latest step in an escalating standoff between Beijing and Washington over access to materials used in the production of high-tech microchips.

Meanwhile, the chart by FT shows just how big a role China plays in the production and processing of rare earth metals.

Follow us on Telegram and Twitter

🌾 Russia first in wheat exports for second straight year

Second consecutive strong wheat harvest strengthens Russia’s position as No. 1 exporter while easing price pressure on markets.

Overflowing Russian grain ports have brought wheat consumers affected by the cost-of-living crisis a positive result: the lowest prices in almost three years.

Prices in the Chicago market are now less than half of the peak reached after the Ukrainian conflict began.

“There are not a lot of competitors for Russian wheat,” said Hélène Duflot, a grain-market analyst at Strategie Grains. “Russia is the price maker at the moment.”

Follow us on Telegram and Twitter

🇦🇷 The IMF grip is set to tighten

Argentina and the International Monetary Fund have had a rocky history, and it appears that things may deteriorate further.

Just five years ago, Argentina became the largest debtor to the Washington-based lender, receiving $57 billion in aid. Unfortunately, the program failed to revive South America’s second-largest economy.

At present, the government has been unable to meet the economic targets set by the IMF.

This has led to mounting pressure, with analysts suggesting that the IMF should adopt a tougher stance when a new government takes office after the October elections.

“No matter who wins after the vote, the IMF should insist that the government either bite the bullet – or otherwise the Fund should pull the plug on its support,” said Mark Sobel, a former US representative at the IMF.

Javier Milei, who emerged as the frontrunner in last month’s primary election, is in favor of dollarizing the economy and believes that the IMF should push Argentina to reduce its primary budget deficit to 1.9% of GDP by 2023.

However, even if Milei wins the October 22 election and assumes power in December, he will need the support of a united congress to pass reforms and implement a new IMF program.

Meanwhile, economy minister Sergio Massa, the presidential candidate of the center-left Peronist coalition, pledged this week to exempt millions of workers from income taxes shortly after receiving new IMF funds. This move could further strain Argentina’s already tense relationship with the fund.

Hence, after the elections, the new president will not only have to address domestic issues but also find a way to negotiate with the powerful lender, which is increasingly dissatisfied with the current policies.

Follow us on Telegram and Twitter