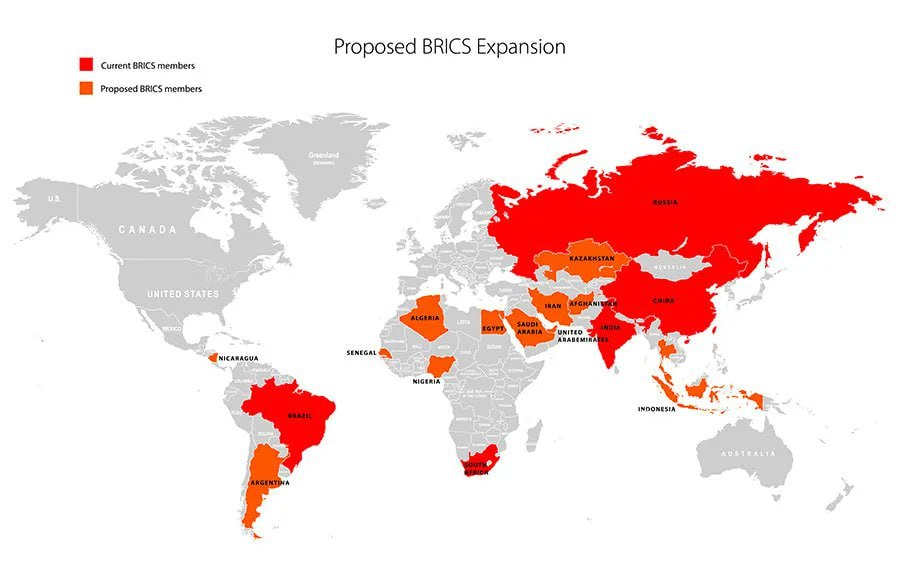

Leaders of the BRICS Five countries and partners of the organization will gather for a summit in Johannesburg on August 22. The meetings will last three days, until August 24.

According to a South African diplomatic source, more than 60 states have been invited to participate in the discussions, including African countries and countries that have applied to join the association.

The program of the meetings has not been officially presented yet, but earlier it was stated that the central topics of the summit will be the criteria for potential BRICS expansion, as well as the strengthening of local currencies within the bloc and the development of a common payment system.

Russia will be represented at the summit by Foreign Minister Sergey Lavrov (he will attend the meeting in person) and President Vladimir Putin, who will participate in the summit via videoconference. Brazil will be represented by President Lula da Silva, India by Prime Minister Narendra Modi, and China will be represented by its leader Xi Jinping. The President of South Africa, Cyril Ramaphosa, will serve as Chairperson.

The UN delegation has also confirmed its participation.

“UN Secretary General Guterres has gladly accepted the invitation to the BRICS summit in South Africa” – spokesman Dujarric said. “He intends to use his participation to deliver a number of important messages,” he added.

Meanwhile, French leader Emmanuel Macron, who has repeatedly expressed his desire to join the forum, did not receive an invitation.

Follow us on Telegram and Twitter

Now the firm, one of the world’s largest homebuilders, has until early September to make the payments or follow hundreds of other developers into default and restructuring. Trading in its bonds, which are worth just pennies on the dollar, was halted on August 14th. 🤣🤣🤣

The firm’s debts are smaller than those of Evergrande, a big, heavily indebted company that defaulted in 2021. But at the start of the year Country Garden was building four times more homes than Evergrande was before it defaulted.

Country Garden’s biggest creditors are not banks or bond holders, but folk who have paid for homes upfront. Some 668bn yuan, or about half the firm’s liabilities, were put up by homebuyers. Last year thousands stopped paying their mortgages in protest at years-long delays in delivering homes. There is now the threat of much broader protests across the 300 cities in which Country Garden builds.

Country Garden almost certainly has the $22.5m it needed to cover payments this month. By not paying up, its bosses are signalling a desire to eventually restructure its debts—perhaps betting that the firm is too big to fail.

This puts the central government in an excruciating position. Letting Country Garden fail could lead to wider panic, more economic pain and potentially more defaults, risking contagion and social unrest.

I pray for our China brothers and sisters but I bid a farewell to Country Garden! Another one bites the dust 💥

China Evergrande Group has sought Chapter 15 bankruptcy protection in New York, court documents showed Thursday.

Chapter 15 bankruptcy protects the company’s assets in the US while it restructures elsewhere. Evergrande’s petition cites restructuring proceedings underway in Hong Kong and the Cayman Islands.

The once most valuable real estate company in the world kicked off China’s real estate crisis in 2021 with a total debt of hundreds of billions of dollars.

Follow us on Telegram and Twitter

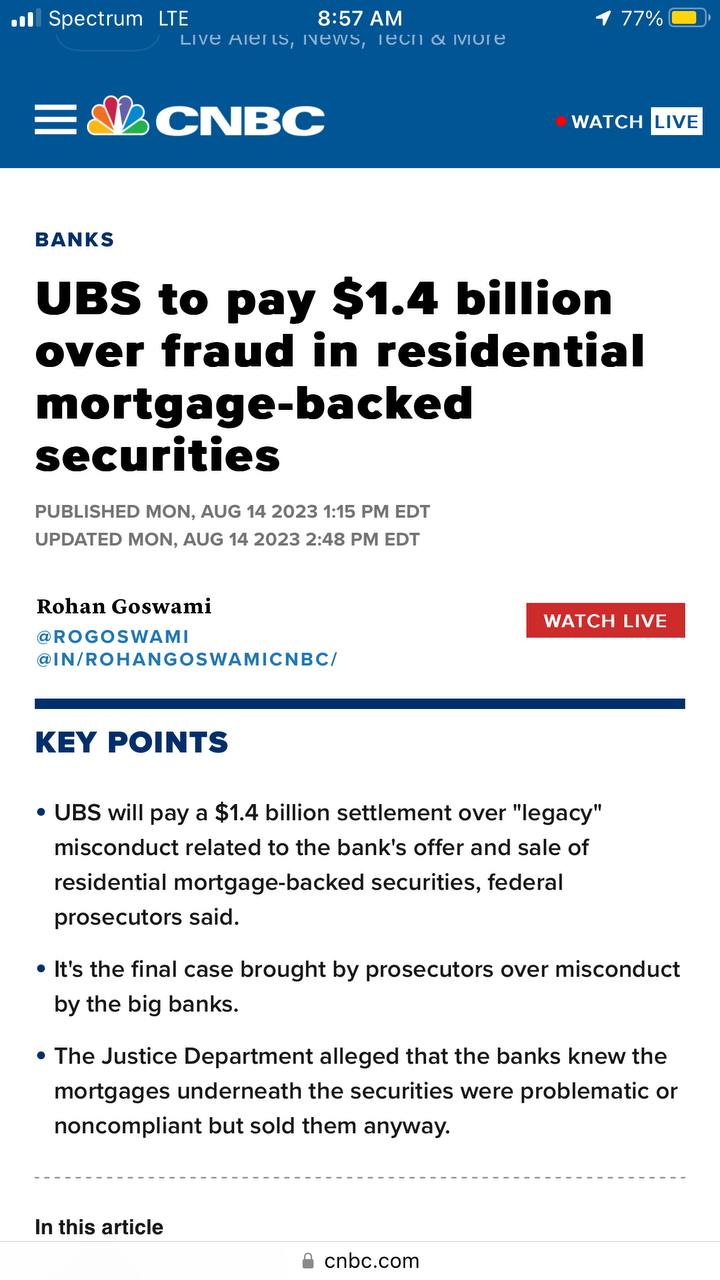

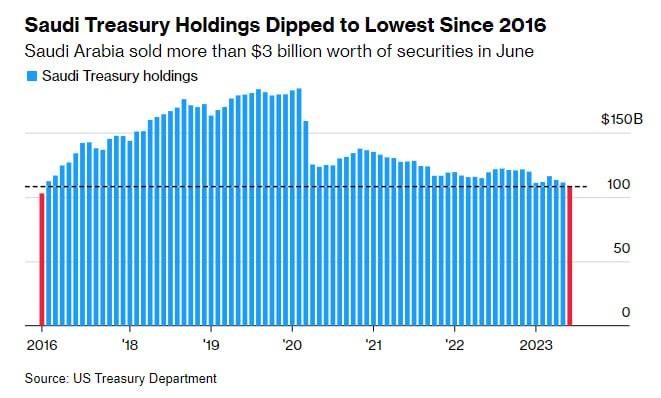

Saudi Arabia’s holdings of US Treasury bonds fell to the lowest level in more than six years.

The country sold more than $3 billion in US government debt in June, offloading the securities for a third consecutive month to bring its holdings to $108.1 billion, according to Treasury Department data. The neighboring UAE sold nearly $4 billion.

Echoing the sell-off, China dumped $11.3 billion in June, bringing it to the lowest level since mid-2009.

Japan and the UK were among the biggest buyers of what’s widely perceived as one of the safest assets to own. But their own economies are continuously pressured by a multitude of factors, and some experts believe that they can barely continue to buy at the same pace.

Falling demand for Treasuries could make it much harder for the US to continue borrowing money as it has historically done.

Follow us on Telegram and Twitter